SBI Pension Loan for Ex-servicemen & Pensioners – SBI Pension Loan ek loan hai jo retired soldiers aur pensioners ko State Bank of India provide karta hai. Is loan ka upyog medical expenses, education, weddings, aur home renovations jaise kaamo ke liye kiya ja sakta hai.

Is loan ke liye aapko ek regular pension income hona chahiye aur aapki umra apply karte waqt 76 saal se kam honi chahiye. Aap kitna loan le sakte hai, yeh aapki umra aur pension ke amount par depend karta hai. Is loan ko aap 84 mahine tak vapis kar sakte hai.

Is loan par interest rate kam hota hai aur repayment period ke dauraan yeh wahi rehta hai. Agar aapke paas SBI ka account hai, toh aapko ek special interest rate bhi mil sakta hai.

Is loan ke liye aapko kuch documents jaise ki pension payment order, bank statements, address proof, aur identity proof submit karna hoga. Is scheme ke madhyam se retired soldiers aur pensioners ko financial aid pradaan karna, SBI Pension Loan ek sahayak yojana hai.

SBI Pension Loan for Ex-servicemen & Pensioners – Features Kya Hai

Loan Amount: Yeh loan borrower ki umra aur pension amount par depend karta hai, jiske anusaar loan amount pradaan kiya jaata hai.

Repayment Tenure: Is loan ki repayment ka samay 84 mahine tak hota hai, jisse borrowers ko loan vapis karne ke liye sufficient time milta hai.

Interest Rate: Is loan par interest rate kam hota hai aur yeh repayment period ke dauraan fixed rehta hai. SBI ke account wale borrowers ko special interest rate pradaan kiya jaata hai.

Eligibility Criteria: Is loan ke liye borrower ka regular pension income hona chahiye aur borrower apply karte waqt 76 saal se kam hona chahiye.

Loan Purpose: Yeh loan various purposes jaise medical expenses, education expenses, wedding expenses, home renovation, etc. ke liye use kiya ja sakta hai.

Documents Required: Is loan ke liye borrower ko kuch documents jaise pension payment order, bank statements, address proof, identity proof, etc. submit karna hota hai.

Overall, SBI Pension Loan retired soldiers aur pensioners ko financial assistance pradaan karne ke liye ek suvidha-janak aur pareshaani-mukt loan scheme hai.

SBI Pension Loan for Ex-servicemen & Pensioners – Eligibility Criteria Kya hai

SBI Pension Loan ke liye eligibility criteria niche diye gaye hain:

- Borrower ka regular pension income hona chahiye.

- Borrower apply karte waqt 76 saal se kam hona chahiye.

- Borrower ko SBI Pension Loan ke liye apply karte waqt pension payment order aur bank statements submit karne ki avashyakta hoti hai.

- Borrower ko loan ke liye apply karte waqt apna address proof aur identity proof bhi submit karna hota hai.

In sabhi criteria ko pura karne ke baad hi borrower SBI Pension Loan ke liye eligible hoga.

SBI Pension Loan for Ex-servicemen & Pensioners – Interest Rate Kya hai

Interest Rate Starts from 11.00 % PA

SBI Pension Loan ke kuch important terms and conditions hai, jo borrower ko dhyan me rakhne ki zaroorat hoti hai:

- EMI/NMP ratio – Family Pensioners ke liye EMI/NMP ratio 33% se jyada nahi hona chahiye aur dusre pensioners ke liye yeh ratio 50% se jyada nahi hona chahiye.

- Prepayment Charges – Prepayment charges 3% hote hai jis bhi prepaid amount par lagu hote hain.

- No prepayment/foreclosure charges – Agar borrower loan ke proceeds se naya loan account under the same scheme khata karta hai to prepayment/foreclosure charges nahi lagte hain.

- Loan Repayment mode – Loan ka repayment mode standing instructions se pension account se EMIs ke recovery ke liye diya jata hai.

- Loan Guarantee – Loan ka guarantee TPG (third party guarantee) dwara secured kiya jata hai, jisme spouse eligible for family pension ya koi aur family member ya third party eligible for pension loan ho sakta hai.

- In sabhi terms and conditions ko borrower ko acche se samajhna chahiye aur inhe loan apply karne se pehle dhyan se padhna chahiye.

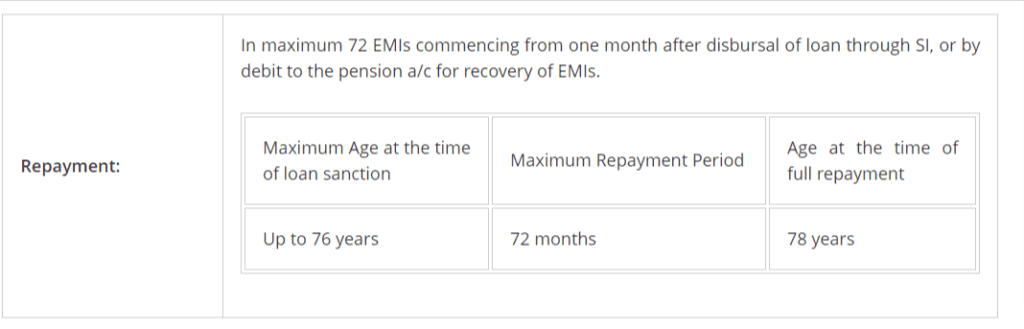

SBI Pension Loan for Ex-servicemen & Pensioners – Loan Repayment Period

SBI Pension Loan for Ex-servicemen & Pensioners – Kon Sa documents submit karne ki zaroorat hoti hai. Yeh documents hai:

- Pension Payment Order (PPO) – PPO, jisme pension details mention ho, ki borrower ki pension kitni hai aur kitne time se mil rahi hai.

- Bank statements – Bank statements jo pension credit ke details ko show karte hai, jisme pension credit kam se kam last six months tak dikhana zaroori hai.

- Proof of Identity – Proof of identity jaise Aadhaar card, PAN card, Passport, Voter ID card, Driving License, etc.

- Proof of Address – Proof of address jaise Aadhaar card, Passport, Voter ID card, Driving License, etc.

In sabhi documents ko pensioners ko sahi tarah se submit karna hoga, jisse loan application process smoothly chale. Borrower ko sahi documents submit karne se pehle SBI ke customer care ya branch se baat kar leni chahiye, kyunki documents ki requirements aur eligibility criteria mein kuch changes ho sakte hain.

SBI Pension Loan for Ex-servicemen & Pensioners – Maximum Eligible Loan Amount Aur Repayments Kya Hai

SBI Pension Loan ke maximum eligible loan amount aur repayment options kaafi flexibly design kiya gaya hai. Yeh factors borrower ki age aur unki pension income par depend karte hain.

Maximum Eligible Loan Amount: Borrower ki age aur unki pension income ke hisaab se, maximum eligible loan amount determine kiya jata hai. Pensioners aur ex-servicemen ke liye maximum loan amount Rs. 14 lakhs tak ho sakta hai. Lekin, ye amount borrower ki eligibility aur SBI ke lending policies par bhi depend karta hai.

Repayment Options: SBI Pension Loan ke liye repayment period 84 months tak ho sakta hai. Borrower ko EMIs (Equated Monthly Installments) ke form mein loan amount ko repay karna hota hai. EMI amount borrower ki loan amount, repayment tenure, aur interest rate par depend karta hai.

EMI/NMP ratio Family Pensioners ke liye 33% se jyada nahi hona chahiye aur all other types of Pensioners ke liye EMI/NMP ratio 50% se jyada nahi hona chahiye.

Loan ke repayment ke liye, borrower ko apne pension account se Standing Instructions provide karne ki zaroorat hoti hai, jisse loan EMIs recover ho sakte hain. Prepayment charges 3% on prepaid amount hai, lekin agar borrower apne loan account ko new loan account ke proceeds se close karta hai, toh us case mein prepayment/foreclosure charges nahi lagenge.

SBI Pension Loan for Ex-servicemen & Pensioners – Apply Now Below

SBI PENSION LOAN CALCULATOR

SBI Pension Loan Calculator

Monthly Payment:

Total Payment:

Total Interest:

SBI Pension Loan for Ex-servicemen & Pensioners – Frequently Asked Questions

How much loan can a pensioner get in SBI?

14 Lacs

What is the maximum repayment period for SBI Pension Loan for Ex-servicemen & Pensioners?

The maximum repayment period will be 3 years.

Which loan is best for pensioners?

SBI Pension Loan

Pension Loan ke liye SBI mein account hona zaroori hai?

Haan, SBI mein account hona zaroori hai.

Kya loan ke liye processing fees lagenge?

Haan, processing fees lagenge. Processing fees 0.50% of the loan amount (minimum Rs. 500) hogi.

Kya pensioner ke spouse ko loan ke liye apply karne ka option hai?

Haan, pensioner ke spouse ko loan ke liye apply karne ka option hai.

Loan application ke liye kya documents chahiye honge?

Pensioner ka pension papers, ID proof, address proof, bank account statement